dc income tax withholding calculator

District Of Columbia Payroll Tax Rates Updated February 3 2022 As the capital of the United States Washington DC. District of Columbia collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Income tax brackets are the same regardless of filing status.

. Ask the Chief Financial Officer. 2015 Income Tax Withholding Instructions and Tables. This center is a gateway for the services and information that personal income taxpayers will need to comply with the Districts tax laws.

Has relatively high income tax rates on a nationwide scale. Unlike the Federal Income Tax District of Columbias state income tax does not provide couples filing jointly with expanded income tax brackets. 2015 Income Tax Withholding Instructions and Tables.

Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me.

Withholding Tax Forms for 2017 Filing Season Tax Year 2016 Please note the Office of Tax and Revenue is no longer producing and mailing booklets. The tax rates for tax years beginning after 12312015 are. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Dependent Allowance 1775 x Number of Dependents Apply the taxable income computed in step 5 to the following tables to determine the District of Columbia tax withholding. 2016 Income Tax Withholding Instructions and Tables. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Round all withholding tax return amounts to whole dollars. 2014 Income Tax Withholding Instructions and Tables. Free Federal and District of Columbia Paycheck Withholding Calculator.

And I qualify for exempt status on federal Form W-4. Yes No D-4 DC Withholding Allowance Certificate Detach and give the top portion to your employer. 2017 Income Tax Withholding Instructions and Tables.

2018 Income Tax Withholding Instructions and Tables. Overview of District of Columbia Taxes. Office of Tax and Revenue.

Office of Tax and Revenue 941 North Capitol Street NE. District of Columbias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

For employees withholding is the amount of federal income tax withheld from your paycheck. DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ. Is known worldwide as a vibrant city full of historical monuments and buildings as well as iconic museums and performing arts venues.

For help with your withholding you may use the Tax Withholding Estimator. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. Global Tips Expatriate Payroll Tips Tax Equalization An Overview DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ.

1101 4th Street SW Suite 270 West Washington DC 20024. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. The information you give your employer on Form W4.

Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Withholding Formula District of Columbia Effective 2021. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or more days during the year or of a DC estate or trust is subject to tax at the following rates. 2014 Income Tax Withholding Instructions and Tables. Individual Income Tax Service Center.

Withholding Formula District of Columbia Effective 2022. All filers must file Form VA-6 Employers Annual Summary of Virginia Income Tax Withheld or Form VA-6H Household Employers Annual Summary of Virginia Income Tax Withheld. The VA-6 and VA-6H are due to Virginia Tax by Jan.

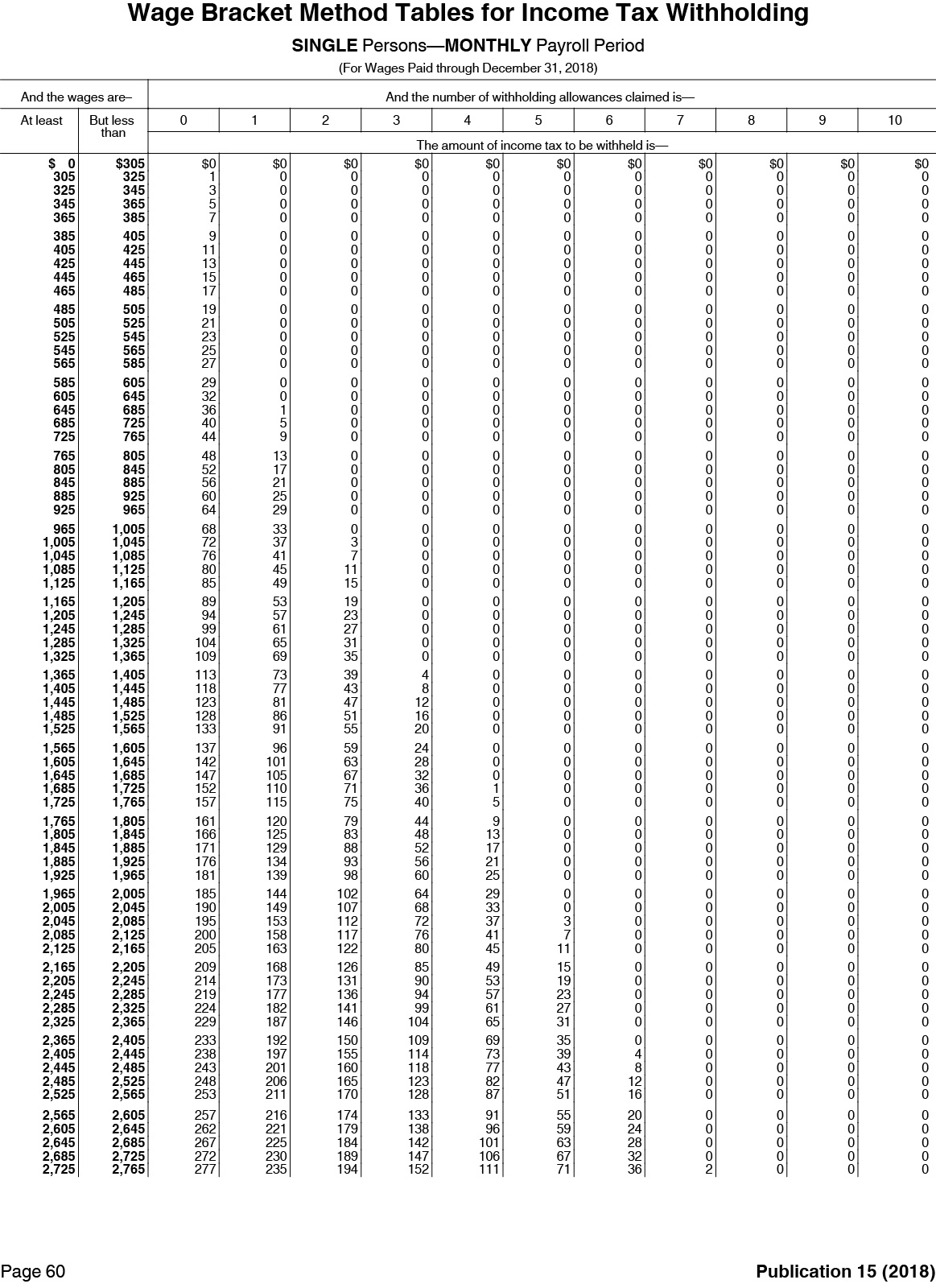

31 of the following calendar year or within 30 days after the final payment of wages by your company. 20002 District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2010 New Withholding Allowances for the Year 2010 The tables reflect withholding amounts in dollars and cents. The amount you earn.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. Rates for Tax Years 2016 - 2019. Tax and period-specific instructions are available within the table Form Title Filing Date.

Use tab to go to the next focusable element. If claiming exemption from withholding are you a full-time student. Monday to Friday 9 am to 4 pm except District holidays.

The amount of income tax your employer withholds from your regular pay depends on two things. After a few seconds you will be provided with a full breakdown of the tax you are paying. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Income Tax Calculator Estimate Your Refund In Seconds For Free

Delaware Taxes De State Income Tax Calculator Community Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

Withholding Allowance Definition Income Tax

State W 4 Form Detailed Withholding Forms By State Chart

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

What If I Entered The Wrong Amount Withheld From Federal Quora

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Taxes Unit Lessons 2 5 Irs Withholding Calculator Consumer Math Money Skills Irs

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

What Are Marriage Penalties And Bonuses Tax Policy Center

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89